Ever wonder where your paycheck disappears after covering rent and groceries? Chances are, discretionary spending is quietly eating into your budget. These non-essential expenses like dining out, streaming subscriptions, or impulse buys—add enjoyment to life, but they can throw your financial goals off track if you’re not paying attention.

Understanding and managing discretionary spending is key to balancing the things you enjoy today with the savings you’ll need tomorrow. In this article, we’ll explain what discretionary spending is, share real-life examples, and offer practical ways to stay on budget—without giving up the fun.

What Is Discretionary Spending?

Discretionary spending refers to the money you spend on non-essential items (source), things you want but don’t need to survive. It’s different from fixed or necessary expenses like rent, utilities, groceries, or insurance. These optional purchases often reflect your lifestyle, hobbies, or personal preferences.

Common Examples of Discretionary Expenses

- Dining out or ordering takeout

- Subscriptions (streaming services, magazines, apps)

- Travel and vacations

- Clothing beyond basics

- Entertainment (movies, concerts, events)

- Tech gadgets and impulse purchases

- Gym memberships and luxury services

While these expenses aren’t wrong or irresponsible, they can easily grow without notice—especially if you don’t track them. The goal isn’t to cut out everything fun. It’s to become more intentional about how you spend.

Discretionary vs. Non-Discretionary Spending

To manage your budget wisely, it helps to understand the difference between discretionary and non-discretionary spending. These two categories often get blurred—but separating them makes it easier to set priorities and identify where you can cut back if needed.

What Counts as Non-Discretionary Spending?

Non-discretionary expenses are essential. They’re the costs you must cover to live and work:

- Rent or mortgage

- Utilities (electricity, water, heating)

- Basic groceries

- Health insurance and medical costs

- Transportation (gas, public transit, car payments)

- Minimum debt payments

These are your “needs,” and they usually take up the largest share of your income.

Discretionary Spending: The “Wants” Category

Discretionary expenses are flexible. You choose how much (or if) to spend in these areas. They often improve your quality of life but aren’t necessary for survival. This makes them easier to adjust when you’re trying to save money or hit a financial goal.

Quick test: If skipping the expense doesn’t impact your safety, shelter, or basic well-being, it’s likely discretionary.

Why Managing Discretionary Spending Matters

Discretionary spending may feel harmless in small doses—but over time, it can quietly eat away at your savings goals or push you into debt. That’s why keeping it in check is a critical step toward financial stability.

Small Expenses Add Up Fast

A coffee here, a delivery fee there—it doesn’t seem like much. But when these purchases become daily habits, they can total hundreds per month. Identifying patterns in your spending helps you spot the leaks before they turn into floods.

Example: Spending $8 a day on lunch during the workweek adds up to over $160 a month—nearly $2,000 a year.

Flexibility in Hard Times

During tight months, having control over discretionary spending gives you breathing room. Unlike rent or loan payments, these expenses are optional. Trimming them temporarily can help you stay afloat without needing to dip into savings or take on debt.

Aligning Spending With Your Values

Being intentional about discretionary spending doesn’t mean cutting out everything you enjoy. It means choosing where your money goes based on what matters most—whether that’s travel, hobbies, or building an emergency fund.

How to Manage Discretionary Spending

Discretionary spending doesn’t have to wreck your budget if you manage it intentionally. A few simple strategies can help you enjoy what you love while still protecting your financial future.

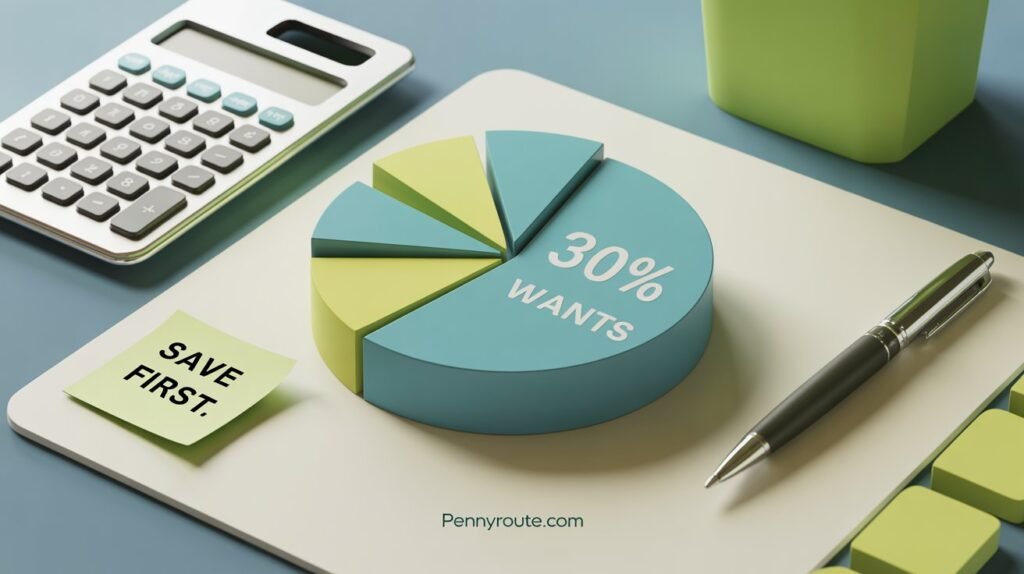

Use a Simple Budgeting Framework

One of the easiest ways to manage discretionary expenses is the 50/30/20 rule. With this approach, you divide your after-tax income like this:

- 50% for needs (housing, food, transportation)

- 30% for wants (your discretionary spending)

- 20% for savings and debt repayment

This guideline helps you set healthy boundaries without tracking every single penny.

Set Monthly Limits on Wants

After you know what falls into your discretionary spending category, give yourself a set amount each month. Treat it like any other bill, so you don’t accidentally overspend. This might mean putting cash in an envelope or using a separate debit card just for “fun money.”

Use Apps or Tracking Tools

Budgeting apps can make it easier to keep your discretionary spending in check. Tools like YNAB or Goodbudget can help you allocate your money ahead of time and track it throughout the month. Even a simple spreadsheet can give you clarity on where your money goes.

Practice Mindful Spending

Not every discretionary expense is wasteful. In fact, some “wants” add genuine happiness to your life. The key is to prioritize what truly brings you value instead of spending out of habit or impulse.

Ask yourself:

- “Do I really want this?”

- “Is there a cheaper alternative?”

- “Will this purchase still matter to me next week?”

By thinking before you spend, you’ll make more satisfying choices.

Tips to Cut Back on Discretionary Spending (Without Feeling Deprived)

Cutting back on discretionary spending doesn’t mean giving up everything you love. It’s about making choices that fit your values and financial priorities, while still enjoying life.

Swap, Don’t Stop

Instead of quitting hobbies or treats cold turkey, swap them for cheaper alternatives. For example:

- Cook with friends instead of going to restaurants

- Try free community events rather than concerts

- Use the library for books and movies

You’ll still have fun, but at a fraction of the cost.

Use the 24-Hour Rule

Give yourself a day to think before buying non-essential items. This simple pause helps you avoid impulse purchases and keep your budget on track.

Cancel Unused Subscriptions

Streaming, magazines, fitness apps—these can quietly drain your budget. Audit your subscriptions every few months and cancel anything you don’t actively use.

Try a No-Spend Challenge

Dedicate a weekend—or even a full month—to spending nothing on wants. Challenges like these help you reset habits and get creative with free or low-cost fun.

Lean on Cash

Using cash for discretionary expenses can limit overspending. It’s easier to see money leaving your wallet, which can help you stick to your plan.

How Discretionary Spending Affects Your Financial Goals

Discretionary spending has a bigger impact on your finances than you might think. While it’s okay to spend money on things that make life enjoyable, unplanned or excessive spending can delay your progress toward larger goals.

Slowing Down Savings

If too much money goes toward wants, you may struggle to build an emergency fund or invest for the future. Small choices, like daily takeout or impulse shopping, can add up and limit what you set aside for your bigger dreams.

Making Debt Harder to Pay Off

When discretionary spending crowds out debt payments, high-interest balances can stick around for years. Redirecting even a portion of “fun” money toward extra payments can save you interest and shorten your repayment timeline.

Disrupting Your Budget

Overspending on discretionary categories can throw your entire budget out of balance. That makes it harder to cover essentials and stick to a plan that supports long-term stability.

Bottom line? Keeping discretionary spending in check is one of the easiest ways to free up money for what matters most—like financial security, debt freedom, and long-term peace of mind.

Conclusion

Discretionary spending is part of what makes life enjoyable, but it shouldn’t come at the cost of your financial peace of mind. By understanding the difference between needs and wants, you can build a spending plan that supports your priorities while still giving you room to enjoy yourself.

Whether you use the 50/30/20 rule, track expenses with an app, or try a no-spend challenge, small steps to manage discretionary spending can make a big difference. Over time, these habits can help you reach savings goals faster, pay off debt sooner, and feel more confident about your money choices.

Ready to take charge? Start by reviewing your last month of spending and see where you can make intentional adjustments—without cutting out everything that brings you joy.

Frequently Asked Questions About Discretionary Spending

What is discretionary spending?

Discretionary spending covers all those non-essential purchases you make after paying for your needs. Think of it as money spent on things you want rather than things you need, like dining out, hobbies, or streaming subscriptions.

What are examples of discretionary spending?

Common discretionary expenses include entertainment, travel, fitness memberships, non-essential clothing, technology upgrades, and other purchases that add enjoyment to life but aren’t necessary for day-to-day living.

How much of my income should go toward discretionary spending?

A simple guideline is the 50/30/20 rule, which suggests putting about 30% of your after-tax income toward wants or discretionary spending. Of course, you can adjust that based on your personal priorities and financial goals.

How do you manage discretionary spending?

Try setting a monthly spending cap, tracking your expenses, or using a simple budgeting method like zero-based budgeting or the 50/30/20 rule. Mindful spending—where you pause before making purchases—can also help keep things in balance.

How can I reduce discretionary spending without feeling deprived?

You don’t have to cut out everything you love. Swap pricier habits for budget-friendly options, pause before buying on impulse, cancel unused subscriptions, or try no-spend weekends to reset your habits.

What’s the difference between discretionary and non-discretionary spending?

Non-discretionary expenses are your “must-haves,” like rent, utilities, and groceries. Discretionary expenses are the “nice-to-haves,” like entertainment, vacations, or hobbies. Knowing the difference helps you budget smarter.

Why is tracking discretionary spending important?

Keeping an eye on your discretionary spending can help you spot money leaks, stay on track with your savings goals, and avoid going into debt. Recent insights on discretionary spending patterns show how even small choices can add up and impact your financial health.